Get Up to $500K in Personal & Business Funding

Business or personal — we help you access fast, flexible funding designed to move life forward.

What We Help You Fund

Startup & Launch Capital

Get your business off the ground with funding that covers marketing, tools, equipment, or stock.

Business Growth

Expand operations, hire staff, or open a second location without relying on credit cards or risky loans.

Credit Building Loans

Build your business credit profile with structured funding designed to strengthen long-term borrowing power.

Auto Finance

Replace, upgrade, or refinance your vehicle with manageable monthly payments.

Mortgages

Secure financing for your first home — even with a thin credit file or past financial hurdles.

Home Improvements

Upgrade your space without draining your savings. Perfect for energy efficiency, extensions, or necessary repairs.

Holidays & Travel

Finance your next break with flexible repayment terms that won’t derail your budget.

Debt Consolidation

Combine existing debts into one lower-interest payment, simplifying your financial life.

Emergency Expenses

Access fast cash when life throws the unexpected your way — medical bills, family emergencies, or urgent repairs.

Why Choose Us?

Soft Credit Search

Check eligibility without harming your score.

We understand how important your credit profile is — especially when you're rebuilding or working toward long-term goals like homeownership or business expansion. That’s why our pre-approval process uses a soft credit search. It gives you a clear view of what you’re eligible for without leaving a mark on your file. No risk, no pressure — just real options you can explore confidently.

Why Choose Us?

Decisions Within 24–48 Hours

We prioritize speed, no waiting weeks to hear back.

When life or business moves fast, funding should keep up. Our process cuts through the delays that come with traditional banks. Once you’ve submitted your application, we typically return with tailored offers within 24 to 48 hours. Whether it’s a time-sensitive purchase or urgent cash flow gap, we move quickly so you can too.

Why Choose Us?

Veteran-Focused Lenders

We work with providers who understand your background — including military income, self-employment, or transitional work.

Most lenders don’t get it — variable income, deployment gaps, or a credit history built outside the typical civilian path often raise red flags. We partner with lenders who’ve worked extensively with veterans and active-duty members. They know how to assess your real financial picture, and they won’t punish you for circumstances that come with service. Whether you're recently discharged, working freelance, or building your business from scratch, we help you get a fair shot.

Quick Pre-Qualification

Fill out a short form — no impact to your credit.

Schedule Call

Talk to an advisor about securing funding up to $500,000.

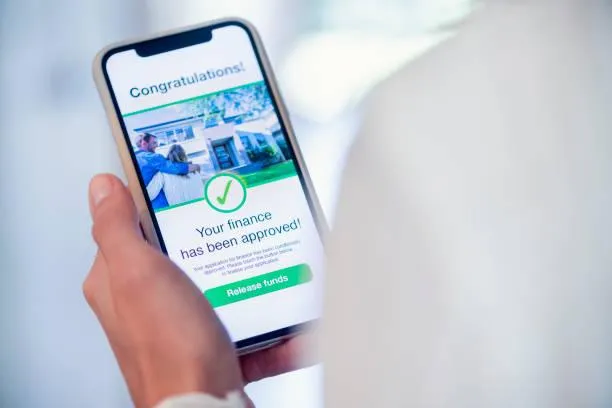

Receive Funds or Credit

You’ll get expert guidance to unlock capital fast and use it strategically.

Ready To Secure Funding And Take Your Business Or Personal Credit To The Next Level?

Whether you’re building your future or taking care of the present, we’ve got funding options that fit.

Who We Are

Built by Entrepreneurs, For Entrepreneurs

We’re not just another funding company — we’re a team of real entrepreneurs, credit strategists, and finance experts who’ve been where you are: big goals, limited resources, and banks that say no.

That’s why we created a better way. We’ve helped hundreds of business owners unlock the capital they need to grow, launch, or bounce back — without the red tape or runaround.

Whether you’re just starting out or scaling to seven figures, our mission is simple: Give you the tools, funding, and confidence to win.

Real Results, No Fluff – I've personally done over $1,000,000 in funding.

No Upfront Fees, Ever – You don’t pay a dime until you get approved.

Tailored Strategies – You’ll get a funding plan built around your goals and timeline.

30+

Years Experience

How We Help You Win

Funding Solutions That Work for You — Not the Banks

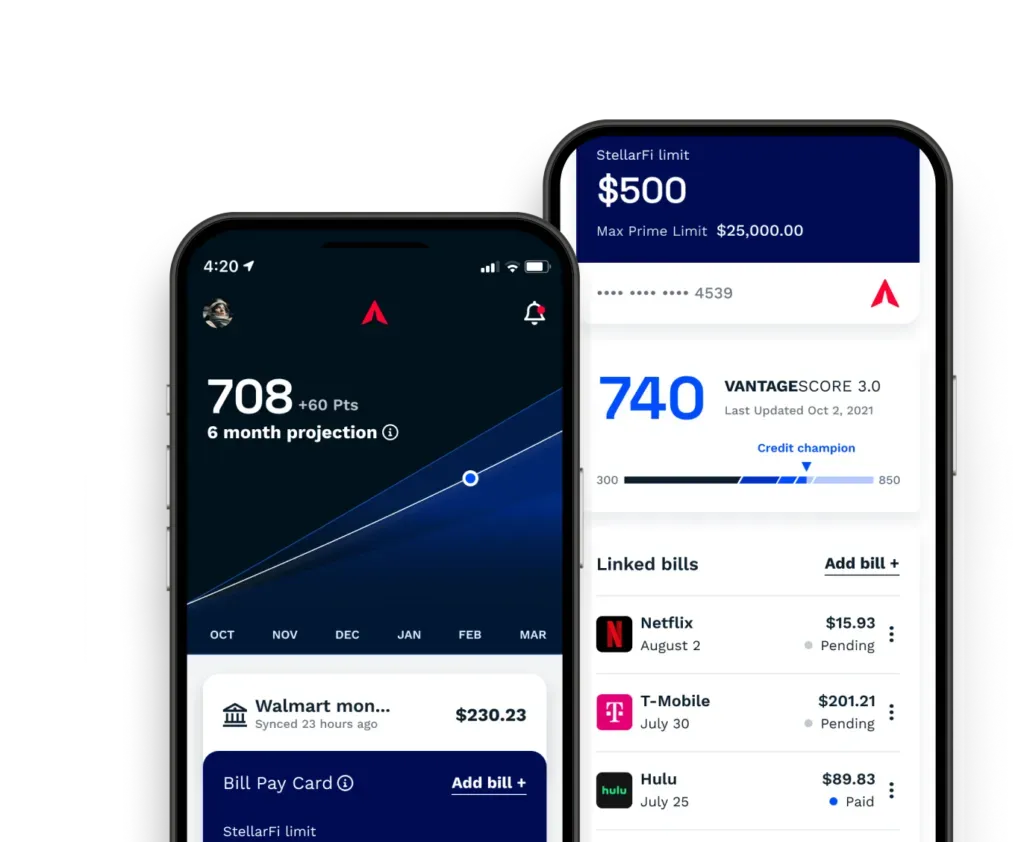

0% Intro Credit Offers

Take advantage of 0% APR credit stacking strategies for 6–18 months.

Unsecured Business Credit Lines

Access revolving credit to cover marketing, payroll, inventory, or expansion.

Term Loans & Working Capital

Get fast, flexible cash to fund your next big move.

What Clients Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

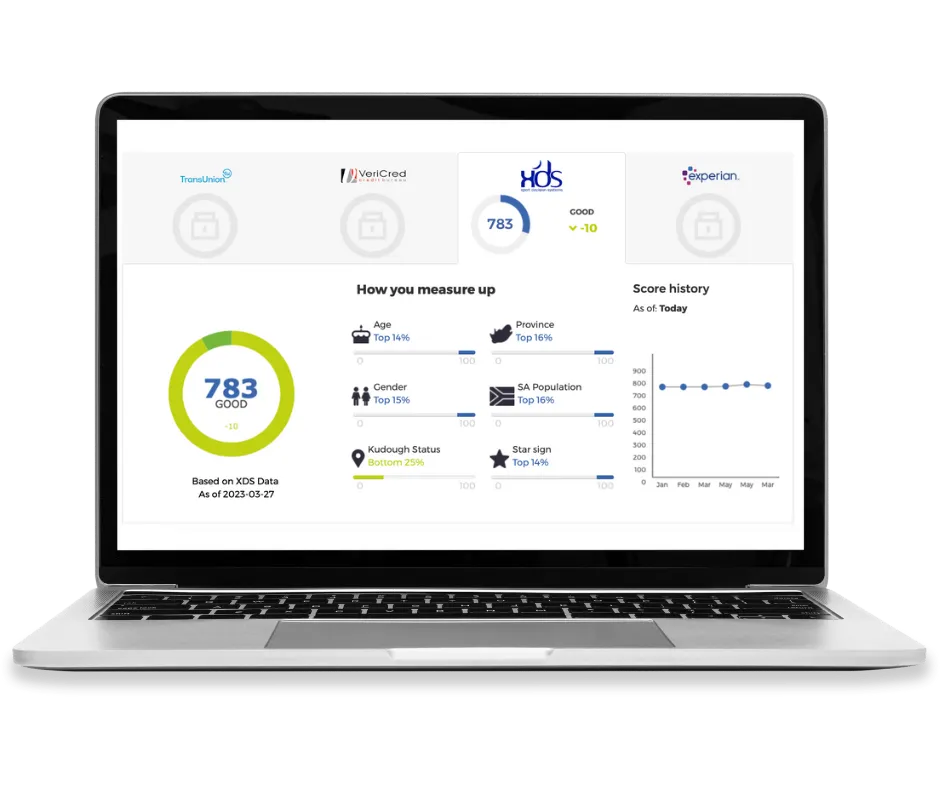

Not Sure About Your Credit?

Click the button below to see your credit score & contact our team to help.

Frequently Asked Questions

What can I use the business funding for?

You can use the funding for almost any business-related expense: launching a new venture, covering payroll, buying tools or equipment, marketing, managing cash flow, or expanding into new areas. The key is that it must support your business operations or growth in some way.

Do I need to have a limited company to apply?

No — you can apply whether you’re a sole trader, limited company, or even a newly registered business. We work with self-employed individuals, contractors, and new business owners who don’t yet have years of trading history.

How fast can I get funded after applying?

In many cases, funding is released within 24–72 hours of approval. If your documents are ready and verified quickly, some offers can be finalised and paid out the same day. We’ll keep the process moving so you can focus on running your business.

Your trusted partner in financial growth and credit success, committed to securing your financial future.